When Do I Need to Buy Workers’ Compensation Insurance? (Hint: Sooner Than You Think)

“I’ll get to it eventually” might work for cleaning out your garage or learning to play the ukulele, but when it comes to the decision to buy workers’ compensation insurance, procrastination is a dangerous game that could cost you your business.

Here’s the thing about workers’ comp: you probably need to buy workers’ compensation insurance right now. Not tomorrow. Wrong, not next quarter. Now.

But don’t take my word for it.

Let’s explore why this seemingly mundane business insurance product might be the most important purchase you make this year.

The “Do I Really Need This?” Question (Spoiler: Yes, You Do)

If you’re an employer wondering when to buy workers’ compensation insurance, I have news for you: the answer was likely “yesterday.” Workers’ comp isn’t just another business expense to minimize or avoid – it’s essential protection for both you and your employees.

Think of workers’ comp as the business equivalent of wearing a seatbelt. You might drive for years without an accident, but if disaster strikes, you’ll be incredibly thankful for that simple precaution.

Workers’ compensation insurance protects your employees if they’re injured or become ill because of their job. It covers medical expenses, rehabilitation costs, and partially replaces lost wages. For you, the employer, it provides crucial liability protection that could save your business from financial ruin.

But here’s the kicker: in most states, it’s not optional. It’s the law.

When “As Soon As Possible” Isn’t Soon Enough

Let’s cut to the chase: you need to buy workers’ compensation insurance the moment you hire your first employee. Not after their probation period. Not once you’re turning a profit. The second they’re on your payroll.

Why the urgency?

Because Murphy’s Law is real, and workplace accidents don’t wait for convenient timing. That new hire could trip over a power cord on day one, leaving you personally responsible for their medical bills if you haven’t secured proper coverage.

“But my business is low-risk,” you protest. “We’re just a small office/coffee shop/consulting firm.”

Tell that to the barista who slips on a wet floor or the office worker who develops carpal tunnel syndrome. Workplace injuries happen everywhere, not just on construction sites and in factories.

The “It Depends” State of Affairs

Here’s where things get a bit more complicated. Workers’ compensation requirements vary wildly from state to state, like trying to follow a recipe where the ingredients change depending on which kitchen you’re in.

Some states demand coverage the moment you hire a single employee, while others give you a bit more breathing room, requiring coverage once you have two, three, or even five employees. Some make exceptions for certain business types or family employees, while others don’t.

When You Need Workers’ Comp Insurance By State

State | Required With | Exact Timing | Special Notes |

Alaska | 1+ employee | Before first employee begins work | No grace period; includes part-time & seasonal |

California | 1+ employee | As soon as operations begin | No minimum hours; includes part-time workers |

Colorado | 1+ employee | Before employees start working | Casual employees <10 days may be exempt |

Connecticut | 1+ employee | Immediately upon hiring | No hour minimum; includes part-time workers |

Delaware | 1+ employee | Before employee begins work | Includes all regular employees |

Hawaii | 1+ employee | Before employees begin working | Includes part-time, temporary & seasonal |

Illinois | 1+ employee | Before employee begins work | No waiting period; includes part-time |

Iowa | 1+ employee | When operations with employees begin | No hour minimum |

Kentucky | 1+ employee | On first day employee begins work | Some agricultural exemptions |

Maine | 1+ employee | Before hiring any employee | Agricultural & domestic workers may be exempt |

Maryland | 1+ employee | As soon as first employee is hired | All regular employees regardless of hours |

Massachusetts | 1+ employee | On day first employee begins work | Includes part-time; no minimum hours |

Minnesota | 1+ employee | When first employee begins work | Family members & casual employees may be exempt |

Nebraska | 1+ employee | When first regular employee begins | Agricultural & household domestic may be exempt |

New Hampshire | 1+ employee | Before any employee begins work | Part-time & full-time count the same |

New York | 1+ employee | From day one of employment | Penalties for even one day without coverage |

North Dakota | 1+ employee | Before employee’s first working day | State-run system; apply before hiring |

Oregon | 1+ employee | Before employees begin working | No minimum hour requirement |

Pennsylvania | 1+ employee | From date of hire for first employee | Domestic & agricultural may be exempt |

Utah | 1+ employee | Before employee begins work | No waiting period allowed |

Idaho | 1+ employee | Before first employee begins work | Some agricultural exemptions |

Indiana | 1+ employee | On/before first day of employment | Some contractors may be exempt |

Louisiana | 1+ employee | Before employee begins work | All employees regardless of hours or duration |

Montana | 1+ employee | Before employee begins work | Household & casual employees may be exempt |

Nevada | 1+ employee | By first day employee begins work | No grace period |

Oklahoma | 1+ employee | From first day of employment | Some small family businesses exempt |

Arkansas | 3+ employees | Upon hiring 3rd employee | No grace period |

Georgia | 3+ employees | As soon as 3+ employees are hired | Before 3rd employee begins work |

Michigan | 3+ employees | When 3+ employees at one time | Or 1 employee working 35+ hrs/week for 13+ weeks |

New Mexico | 3+ employees | As soon as 3 employees are hired | Includes part-time; no waiting period |

Vermont | 2+ employees | Before 2nd employee begins work | Takes effect immediately when 2nd is hired |

Wisconsin | 3+ employees | When 3+ employees are employed | Before 3rd employee begins work |

Alabama | 5+ employees | Once 5+ employees are employed | Before 5th employee begins work |

Mississippi | 5+ employees | When 5+ regularly employed | As soon as 5th employee is hired |

Rhode Island | 4+ employees | When 4+ employees are employed | Before 4th employee begins work |

Tennessee | 5+ employees | Once 5+ employees are employed | Construction/coal mining: required with 1+ |

Virginia | 3+ employees | Once 3+ regular employees hired | Before employees begin work |

West Virginia | 5+ employees | When employing 5+ employees | Before employees begin work |

Florida | Varies | Construction: 1+; Non-construction: 4+ | Before employees begin work |

Missouri | 5+ (1+ construction) | When employee threshold is reached | Must be in place immediately |

North Carolina | 3+ employees | When regularly employing 3+ | Before 3rd employee begins work |

South Carolina | 4+ employees | When 4+ regularly employed | Or when annual payroll exceeds $3,000 |

Texas | Optional | Voluntary for most private employers | Must notify employees if not covered |

Wyoming | 1+ in hazardous industries | Before employee begins work | State-run system |

Ohio | 1+ employee | Before hiring any employees | State-run system; register with BWC first |

Washington | 1+ employee | Before any employee begins work | State-run system; domestic workers exempt |

Note: This chart represents the most current information available as of publication. Workers’ compensation laws can change, so always verify requirements with your state’s workers’ compensation board before making decisions.

And if you have employees working remotely or across state lines? You’ve entered a whole new dimension of complexity.

The only constant is that ignorance of your state’s requirements won’t protect you from penalties. “I didn’t know” has never been a winning legal defense strategy.

The “But They’re Not REAL Employees” Myth That Could Cost You Everything

Think you’ve found the loophole in workers’ comp requirements? That part-timer who only comes in on Tuesdays, the designer working from her cabin in Vermont, or that “independent contractor” who’s been with you for three years?

Sorry to burst your bubble, but the workers’ comp regulators aren’t impressed by your creative classification strategies. Here’s the uncomfortable truth:

- Part-time employees? Yes, you need to buy workers’ compensation insurance for them too. The law doesn’t distinguish between your full-time marketing director and the person who comes in three days a week to answer phones.

- Remote workers? Absolutely, you need work comp for remote employees. Just because they’re working from their living room doesn’t mean they’re not your responsibility. That employee who trips over their dog while rushing to answer a work call? That could become your problem without proper coverage.

- Contractors? Well, that’s where it gets tricky. In some states, you’re on the hook for contractors; in others, you’re not. Some states look at what the person actually does rather than what you call them. This is definitely territory where you’ll want professional guidance.

“But It’s Not Required Where I Live!”

Maybe you’ve done your homework and discovered you’re in a magical jurisdiction where workers’ comp isn’t mandatory for your business. Should you skip it and pocket the savings?

That would be like skipping home insurance because no one requires it. Sure, you could—but one fire, flood, or falling tree later, you’d be wishing you hadn’t.

Even when workers’ compensation insurance isn’t legally required, there are compelling reasons to buy it anyway:

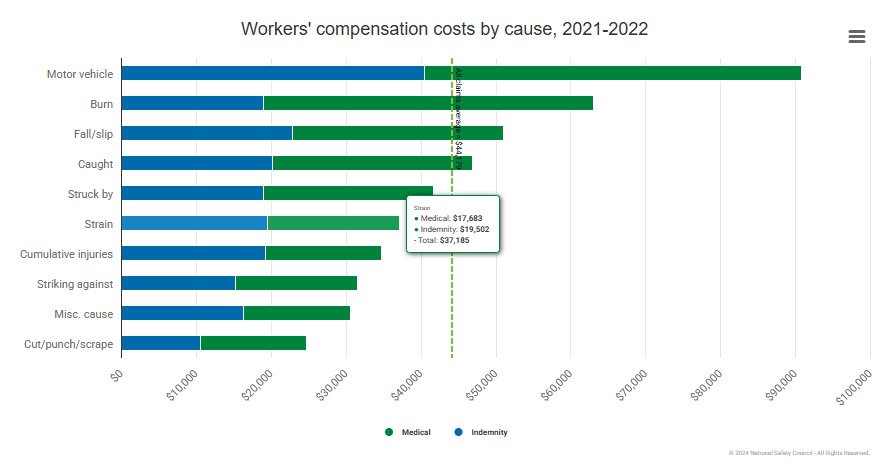

- Self-preservation. Without workers’ comp, you could be personally liable for medical bills, lost wages, and potentially lawsuit damages. The average workers’ comp claim is over $41,000. Can your business absorb that kind of unexpected expense?

- Employee recruitment and retention. Try explaining to potential hires that if they’re injured at work, they’re on their own. Not exactly a selling point in a competitive job market.

- Safety resources. Many workers’ comp providers offer safety training and resources that can actually help prevent workplace accidents in the first place.

- Contract requirements. Many clients and partners won’t work with businesses that lack proper insurance coverage, including workers’ comp.

The “What If I Just… Don’t?” Gamble

Maybe you’re thinking: “What’s the worst that could happen if I just… don’t buy workers’ compensation insurance?”

Let me paint that picture for you:

- Financial penalties that make the cost of insurance look like pocket change

- Possible criminal charges (yes, really)

- Personal liability for employee medical expenses and lost wages

- Potential lawsuits with no liability protection

- The very real possibility of losing your business entirely

According to the National Safety Council, the average workers’ comp claim settlement was $41,358 for data collected from 2019 to 2022. That’s more than many small businesses have in their emergency fund.

The Bottom-Line Question: “How Much Is This Going to Cost Me?”

Ah, now we’re getting to what’s really keeping you up at night. How much do you need to budget to buy workers’ compensation insurance?

The national average is about $1.29 per $100 of payroll, but your actual workers’ compensation costs will depend on several factors:

- Your industry (roofing company vs. accounting firm)

- Your location (workers’ comp rates vary dramatically by state)

- Your claims history (previous workplace injuries)

- Your payroll size

- The types of jobs your employees perform

A good insurance agent can help you navigate these variables and find the best coverage at the most reasonable price. They might also suggest ways to reduce your premiums, such as:

- Implementing workplace safety programs

- Taking advantage of pay-as-you-go options to help with cash flow

- Exploring industry-specific discounts and programs

So, When Do You Need to Buy Workers’ Compensation Insurance? Yesterday.

The best time to plant a tree was twenty years ago. The second-best time is now. The same principle applies to workers’ compensation insurance.

If you already have employees and no workers’ comp coverage, stop reading this and call an insurance agent immediately. Seriously. This article will still be here when you get back.

If you’re planning to hire soon, put “buy workers’ compensation insurance” at the top of your pre-hiring checklist, right above “order business cards” and “set up payroll.”

And if you’re a solo entrepreneur dreaming of future expansion, keep workers’ comp in mind as a necessary step in your growth plan.

Workers’ compensation insurance isn’t the most exciting aspect of running a business, but it is one of the most important. It protects your employees, your business, and ultimately, your dreams of entrepreneurial success.

Don’t wait for a workplace accident to convince you of its value. By then, it will be too late.

Ready to take the next step? Contact us or start your quote online. Your future self (and your employees) will thank you.

Compare Business Quotes

Looking for business insurance? Click “Start a Quote” to compare Business Owner’s Policy and Worker’s Compensation rates. Ready to purchase? Choose “Quote & Buy Online” to buy directly online.

Rather speak with an insurance agent?

1-877-334-7646